2 May 2022. The global economy has been navigating evolving supply chain crises since mid-2020, and some of the associated challenges seem to be growing more complex.

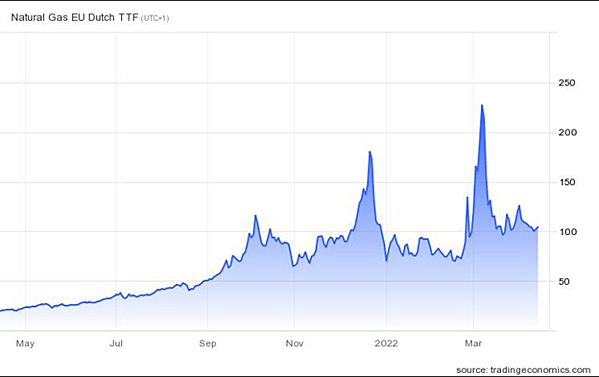

Regarding volatile energy prices specifically, Russia’s invasion of Ukraine in late February has caused major disruptions across the world, for which there are no simple solutions. Skyrocketing energy prices are impacting all of Europe with rippled effects to the rest of the world as prices have reached new highs that have tested paper producers across the board. The registered €225+ level of natural gas has resulted in the temporary curtailment and shutdown of mills across all paper grades in countries experiencing the highest energy prices.

Unfortunately for the region, the volatility continues and there is no clear light at the end of the tunnel. As of this writing, Russia has cut off gas supplies to Poland and Bulgaria. Even after prices experience some relief, there is a strong possibility that a quick reversal and price spike could return.

In a worst-case scenario for the pulp and paper industry, when looking at possible outcomes, the closure of the Nordstream pipeline would likely create a gas scarcity that would significantly impact companies in locations more exposed to gas supply constraints. To get ahead of the situation, some Southern European countries have announced financial support to energy-intensive industries. However, as stated by Spanish Prime Minister Pedro Sanchez, there is unfortunately a limit on what the country´s treasury can support. The support provided will most likely be short-termed, and even then will not be enough to offset the price pressure paper manufacturers are facing.

While this is a tough situation to navigate, the pulp & paper industry needs to be prepared—now more than ever—to “brace for impact,” though it’s important to keep in mind that these changes will not affect all players in the same way. There are different factors that will have different results on the viability of each industry player, such as:

Mix of energy sources

Technical age of assets

Geography and energy source exposure

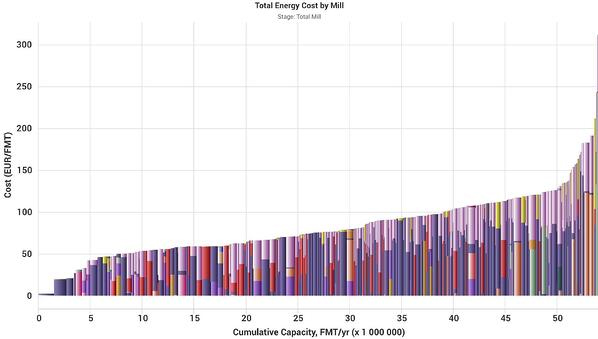

Being able to quickly analyze the different possible scenarios that could arise due to current energy challenges helps provide a clear picture of which mills or lines are more likely to close or curtail production going forward. This kind of analysis also provides insights into where the next merger and/or acquisition opportunities will emerge.

Some questions to think about during this unpredictable time include:

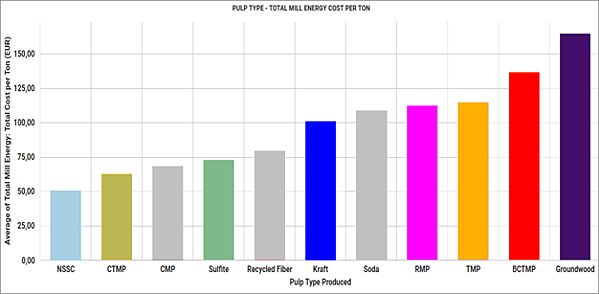

Which grades are more exposed to gas and electricity price increases? Through FisherSolve’s ability to provide detailed data on virtually every mill the world, we can get a clear overview of which grades use more energy to produce – and are therefore more at risk for greater price increases.

How will the viability risk change with the total energy increase? The picture below depicts the different types of energy used as input for fuel, steam, and power generation. Mills who use gas as a form of energy are shown in the purple, and those that will experience an increase in cost.

Mill Viability

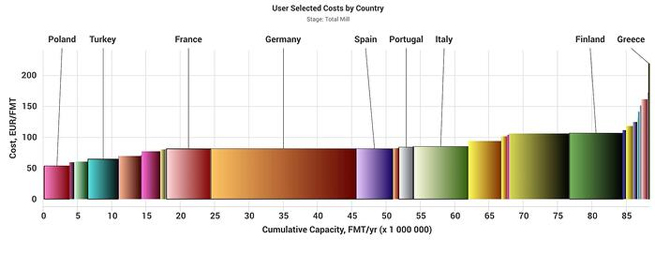

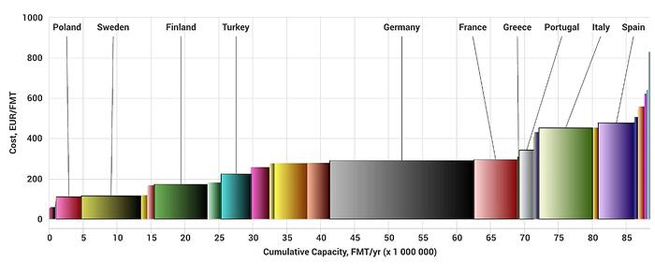

Which countries have technical setups more exposed to gas price increases? What would be the effect of gas prices returning to 200EUR/MWh level? The images below show actual current gas prices compared to if prices were at 200EUR/MWh.

Gas Prices (Actual)

Gas Prices (at 200EUR/MWh)

As illustrated above, the gas price increase of earlier record levels doesn’t affect many countries who have already made the transition to alternative fuel options. However, countries like Italy and Spain will be much more sensitive to such price changes as their technological options still heavily rely on gas-based solutions - and with FisherSolve, you can drill this type of information down all the way to the mill line level.

If there’s anything we’ve learned since the beginning of 2022, it’s that we should be prepared for a BANI (brittle, anxious, non-linear, incomprehensible) world and economy. Fisher International can help businesses prepare for ongoing volatility through the use of our business intelligence platform FisherSolve. In combination with our consulting services, we can help provide the answers to important questions by explaining these market movements in verifiable, fact-based terms that industry professionals find useful.

By Luis Sampaio https://www.paperadvance.com