31 Dec 2021. Fisher International has produced the following initial review of 2021, ahead of more detailed reviews that will appear later in the year when more figures have been verified.

Printing and Writing Papers

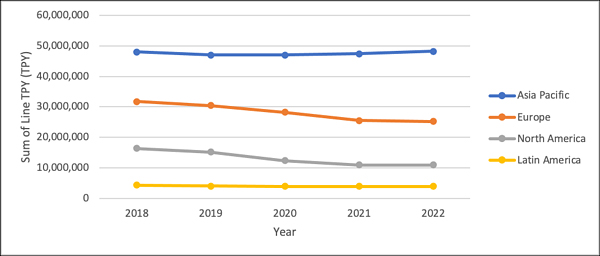

The Printing and Writing segment has been a declining sector for a number of years as the digital age has matured. In 2020, we witnessed an acceleration in this trend as demand for printing and writing papers diminished as a result of the global lockdowns that were put in place as precautionary measures to contain the spread of the Covid-19 pandemic.

However, in 2021, there has been an increased return to in-person schooling and the workplace, resulting in a small uptick in demand. In response to this bump in demand, Domtar announced its plans to restart its Ashdown mill, which is expected to resume full operation in January 2022 and add approximately 185,000 tons of uncoated freesheet to the market.

As illustrated in the chart above, Europe experienced the most dramatic decrease in capacity from 2020 into 2021 as a response to the lack of demand. However, North America and Asia are expected to experience a slight increase in capacity in 2022, with Asia Pacific expected to have the most substantial increase with an estimated 726,000 TPY of added capacity.

E-Commerce and Corrugated

Throughout 2020, we witnessed e-commerce skyrocket to rates never seen before as consumers acclimated to a new way of making everyday purchases during the pandemic. This was a structural change to the market that was largely accelerated due to the pandemic. As the pandemic has amplified consumers’ desire for convenient, on-demand shopping, many companies are now focusing on enhancing their infrastructure to deliver an improved and more personal online shopping experience with features such as augmented reality that allows consumers to virtually try on the products.

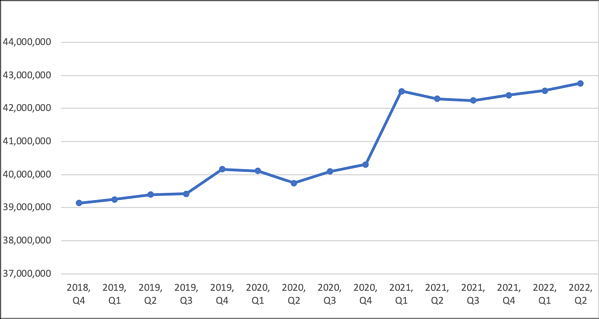

As a result, containerboard demand and capacity has been impacted greatly. Of the three main drivers behind the growing demand for corrugated in the US (durable goods, non-durable goods, and e-commerce), e-commerce was the primary channel that drove most of the gains in corrugated packaging since 1Q2020.

As illustrated in the chart above, 1Q2021 US containerboard capacity skyrocketed in response to the increase in demand from the e-commerce sector. Capacity throughout the rest of 2021 remained strong, and further growth is expected into 2022.

Ongoing Innovation

Throughout 2021, we’ve seen a number of industry participants announce new initiatives that could have a significant impact on global markets in the future. Some notable announcements to keep an eye on include:

Suzano’s New Pulp Capacity: The Brazilian pulp and paper company, and also the largest pulp and paper company in Latin America, announced plans earlier this year to build a new pulp mill in the municipality of Ribas do Rio Pardo in the state of Mato Grosso do Sul. Once complete in 2024, this new project (referred to as the Cerrado Project) will be the world’s largest pulp mill and will have the capacity to produce 2.3 million tons of eucalyptus pulp annually. Suzano is the largest pulp producer in the world by volume, and with a presence in over 80 countries, this new project is expected to open a number of doors for the pulp industry—and for the Brazilian economy as a whole.

Essity’s Non-Wood Pulp: Essity has been working on developing tissue products using pulp made from straw, which is processed to create a bleached pulp finished product. The development of products using pulp made from non-wood is purported to have properties comparable to virgin pulp made from wood in brightness, strength and softness. Essity’s new pulping process, which was developed by Sustainable Fiber Technologies (SFT), is called the “Phoenix Process™,” and some of the goals for this new method of producing pulp include:

- Improving the sustainability of finished products, specifically reducing carbon footprint, water and energy consumption

- Increasing the flexibility of fiber furnish

- Reducing the dependency of externally purchased pulps

- Differentiating themselves from the competition by the use of a new furnish

Klabin’s Eukaliner: Brazil’s largest producer and exporter of paper and paper packaging is challenging the notion that softwood pulp is exclusively required to produce high-quality kraftliner through their production of Eukaliner. Apart of its Puma II project, Eukaliner is the world’s first kraftliner using 100% eucalyptus fiber. It will be produced on Klabin’s PM27 machine located in Ortigueira, Paraná and has numerous purported advantages, including:

- Reduced weight

- Superior print quality and performance

- Steam savings in corrugators

- Better structure and strength during corrugated packaging production

Tissue and Towel

While toilet tissue has always tended to be a steady staple in North America, many consumers well remember when it quickly became one of the world’s hottest commodities for several months during 2020. Hoarding commodities in times of stress is a well-known coping mechanism to provide a sense of security. Historical attempts to limit purchases have tended to make panic worse in the short-term. In reality, toilet paper hoarding is limited by the amount of space that consumers have to store their stashes. North American consumers have the most space, but it is still limited. Hoarding behavior of a bulky product is therefore self-limiting.

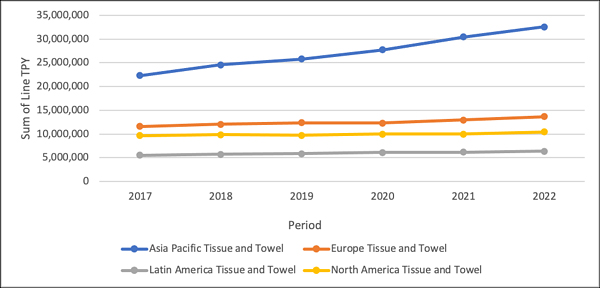

The growth of the tissue segment will continue to be a long-term process driven by evolving consumer behavior patterns.

As illustrated above, tissue capacity is expected to expand in 2022, especially within the Asia Pacific region. Tissue manufacturing has long-term development potential for China’s paper industry, and Fisher predicts that in the next five years, the average annual growth rate of China’s tissue market will reach about 5.5% and its tissue market will reach about 13 million tons by 2025.

Despite another year of ongoing uncertainty and rapidly evolving trends, markets and economies, 2021 has created new opportunities for different industry segments going forward. While we look for some degree of ongoing volatility in the near term, we’re optimistic and excited to see what the Pulp and Paper industry can accomplish in 2022.

By Fisher International

https://www.paperadvance.com/